In just a few years, over-the-top (OTT) services have gone from being a niche streaming option to one of the most popular ways to watch TV. In fact, streaming video content had a higher audience share and bigger revenue than cable TV this year.

As the industry continues to grow, marketers and entrepreneurs need to stay up-to-date on the latest OTT trends and statistics.

Below are some of the most interesting stats from 2024 thus far. Keep in mind that these numbers are likely to change as the market evolves, so make sure to check back often!

Top 9 OTT Statistics for 2024 and Beyond

Revenue from the OTT industry continues to grow at an unprecedented rate, and it’s expected to reach $316.40bn in 2024. Meanwhile, the global OTT video market size is expected to top $476 billion by 2027.

Here are the top 9 OTT statistics that prove how much the OTT industry has grown when it comes to revenue:

- With 21 hours of content consumed per week, Americans spend the equivalent of a part time job streaming digital media in 2024. (Forbes)

- Revenue in the OTT Video market is projected to reach US$316.40bn by 2024. (Statista)

- When streaming video, 65% of the time it’s done on mobile and TV apps rather than on browsers. (Uscreen)

- Over 90% percent of American adults access streaming video platforms, while only 40% have cable or satellite service. (CordCutting)

- The average viewer spends $50 monthly on streaming services across four different platforms, with Netflix being the most popular. (CordCutting)

- One in three of the remaining cable/satellite subscribers would cancel their connections if their preferred sports content was available on streaming platforms. (CordCutting)

- SVOD will remain the principal OTT revenue source, growing by $19 billion between 2023 and 2029 to $127 billion. (Digital TV Research)

- Global OTT TV episode and movies revenues will reach $215 billion in 2029; up by $53 billion – or 33% – from $162 billion in 2023. (Digital TV Research)

- The over-the-top video (OTT video) market reached over 120% penetration rate in the United Kingdom in 2023. Ranked second was Canada at over 117%. (Statista)

OTT market revenue & overview statistics

The OTT market share and revenue are becoming more massive each year, thanks to the yearly growth of subscriptions globally.

Interested in a slice of the OTT pie? Here are statistics on its growth rates and some other valuable metrics for you.

- The global OTT video market size is expected to top $476 billion by 2027. That’s compared to $238 billion in 2021. Today, the U.S. accounts for about 46% of that global market size. (Global Logic)

- Revenue in the OTT Video market is projected to reach US$316.40bn by 2024. (Statista)

- Revenue is expected to show an annual growth rate (CAGR 2024-2029) of 6.30%, resulting in a projected market volume of US$429.40bn by 2029. (Statista)

- The largest market is OTT Video Advertising which is expected to have a market volume of US$191.30bn in 2024. (Statista)

- In global comparison, most revenue will be generated in the United States (US$132,900.00m in 2024). (Statista)

- In the OTT Video market, the number of users is expected to amount to 5.7bn by 2029. (Statista)

- User penetration will be 60.8% in 2024 and is expected to hit 70.1% by 2029. (Statista)

- The average revenue per user (ARPU) in the OTT Video market is projected to amount to US$12.18 in 2024. (Statista)

- Revenue from global subscription video-on-demand (SVOD) is predicted to surpass $136 billion dollars by 2027. (Digital TV Research)

- The average revenue per user (ARPU) in the Video Streaming (SVOD) market is projected to amount to US$265.00 in 2024. (Statista)

- 99% of US consumers have at least one video streaming subscription, with 2.9 subscriptions being the average. (Forbes)

- China, Japan, and India are set to be the leading markets for OTT video services in Asia-Pacific by 2027. (Digital TV Research)

- The Asia-Pacific region will increase OTT TV and movie revenue by 62% to $52bn by 2027. (Digital TV Research)

- By 2027, Latin America will have 139 million subscribers to OTT streaming platforms, that’s up 67% from 83 million in 2022. (Statista)

- Projections indicate that the number of OTT video users in India will reach a staggering 4,216.3 million by 2027, with a user penetration rate of 53.0%. (Times of India)

- Global AVOD revenues for TV and Movies to hit $69 by 2029. (Digital TV Research)

- Global SVOD subscriptions will increase by 321m between 2023 and 2029 to reach 1.79bn. (Digital TV Research)

- The market size of the Transactional Video on Demand (TVOD) market is projected to reach over US$13bn by 2028, with an annual growth rate of about 9%. (Statista)

- Global pay TV revenues are expected to fall by $26m by 2028 from $151 billion recorded in 2022. (Statista)

- Global Free Ad-Supported Streaming (FAST) revenues for TV series and movies will reach $9.06bn revenue in 2024. The market size is expected to reach $11.83bn by 2027.(Statista)

- US connected TV (CTV) ad spend will continue to grow through 2027, when it will reach $40.90 billion. (Insider Intelligence)

- OTT video subscription revenues will hit $50.56 billion this year, an increase of 12.5% YoY. Revenues will climb to $64.12 billion by the end of 2026. (Insider Intelligence)

OTT platforms and apps statistics

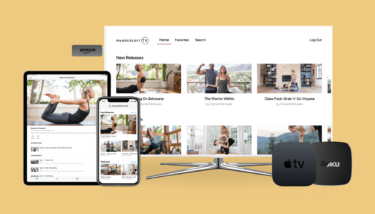

Streaming media onto phones and TV through apps continues to expand in both expected and unexpected ways.

TV apps and mobile video is a valuable market to be in and one that Uscreen supports creators with. We can already see from our own numbers that having an OTT app makes great business sense due largely to smartphone innovations.

- Data from Digital TV Research predicts revenue from global OTT TV episodes and movies will reach $215 billion in 2029. This is a rise of $53 billion on 2023 revenues which were $162 billion. (Digital TV Research)

- More than one in four streamers plans to cancel at least one of their subscriptions this year. Nearly 45% said they’re canceling due to a lack of interesting content. (CordCutting)

- Globally, there are 6.93 billion smartphones capable of running apps, with 85.68% of the world’s population owning one. (Bank My Cell)

- The most popular mobile operating system across all markets is Android with a 69.94% share of the market, with iOS on 29.32%. (GlobalStats StatCounter)

- In the US and Canada, Apple has a much larger mobile market, with iOS earning 58.19% market share to Android’s 41.39%. (GlobalStats StatCounter)

- Whilst at the other end of the scale, in the South American smartphone market, iOS is only on 15.88% of devices compared to 83.86% that Android is on. (GlobalStats StatCounter)

- When streaming video, 65% of the time it’s done on mobile and TV apps, rather than on browsers. (Uscreen)

- At 80.13 million, the most popular OTT TV app in North America as of 2024 is Netflix with a 31% share of total streaming subscribers across the continent. (Forbes)

- The global sports rights spending of subscription OTT services reached $5.2 billion in 2022, this was a marked increase from prior years. Forecasting shows spending will continue to grow. (Statista)

OTT advertising statistics

As a marketer, could you even have imagined the size of the OTT ad market just a few years ago?

Ad spend and ad revenue across OTT video have skyrocketed, and the data tells us that it’s only going to get bigger.

Is it effective? Are users paying attention to all these screens at hand? Let’s take a look at how OTT advertising is reaching the masses.

- OTT video advertising is set to have ad revenues of $191.30 billion by 2024, which is more than half of all OTT revenues. (Statista)

- TV ad spend is expected to still significantly exceed streaming’s spend reaching an estimated $60.56 billion in 2024, while streaming will make up the remaining third of combined US TV and streaming ad spend. (Insider Intelligence)

- When OTT viewers own a second screen, 65% of them will look up product information on the other screen whilst watching content on their main screen. (Video Advertising Bureau)

- In general, 59% of Americans are okay with advertising in return for free OTT content. (Statista)

- The total number of users of AVOD services is set to increase to 3.4 billion people by 2027. (Statista)

- Global OTT video market expects user penetration to increase by 70.1% by 2029. (Statista Advertising & Media Outlook; Statista)

- Global revenues from streamed TV and movies will reach $224 billion by 2027. (Digital TV Research)

- The average revenue per user (ARPU) for OTT video advertising is expected to hit US$12.18 in 2024. (Statista)

- The total digital video advertising spending in the US is expected to increase to $112.77 billion by 2028. (Statista)

OTT streaming services statistics

The way we consume content has been changing slowly for years. More and more people are streaming content on their mobile phones as OTT continues to evolve.

Netflix was the most popular streaming service, with the most subscribers. But the competition in this industry is tough. It’s hard to retain subscribers, especially when there is less exclusive and new content.

Here are some statistics about how OTT viewers use different services.

- Top 5 streaming platforms as of 2023 are: (CordCutting)

- Netflix(73%)

- Amazon (67%)

- Hulu (52%)

- Disney+ (42%)

- Max (39%)

- One recent survey shows that almost all US households, 99% to be precise, subscribe to at least one OTT streaming media app, in 2024. (Forbes)

- On average, Americans pay for 2.9 streaming subscriptions every month, a sign of things to come as people hop between services to get the content they want. (Forbes)

- Netflix is the biggest OTT service in the US and Canada in terms of revenue, with 31% of all subscription revenues heading their way. (Forbes)

- With more than 260.28 million subscribers, Netflix is the most popular streaming service worldwide in 2024. Amazon ranked second with 200 million subscribers. (Forbes)

- 44% of streaming users indicated that Disney+ would be the first service they would drop if subscription prices increased. Disney+ is followed by Hulu and ESPN+, at 40% and 35% users respectively. (Forbes)

OTT live streaming statistics

Whether it’s global sporting events, your favorite musician, or hours of computer games, OTT live streaming has become a huge business.

- By 2024, it’s forecasted that live video viewers in the US will reach 164.6 million. (Statista)

- Live video streaming is expected to have a revenue of $184.27 billion by 2027. (Grand View Research)

- The live streaming market is expected to grow to $3.21 billion in 2027 at a CAGR of 21.2%. (Research and Markets)

- During the third quarter of 2023, live streaming recorded an audience reach of almost 28% across global internet users. (Statista)

- Number of live streams for the online learning industry rose by 120% from 2021 to 2022. (Uscreen internal data)

- The total watch time for the faith & spirituality industry rose by 300% in a year. (Uscreen internal data)

- The average live stream duration increased by 30% in 2021. (Uscreen)

- There were 5900 average live streams created by Uscreen users each month, and an average of 46,000 users watched a live stream per month in 2021. (Uscreen)

- The total watched time of live streams on the Uscreen platform was 338,000 hours in 2021.

- The most popular stream on the Uscreen live streaming platform in 2021 had 318,000 views. (Uscreen)

OTT TV statistics

While TV has been a mainstay in family homes since broadcast TV in the US began in 1947, where we get our content from has been changing in the last few years.

Watching content from the internet is changing what we watch and how we pay for it, and here’s what you need to know when you’re considering starting or expanding your OTT TV business.

- Pay TV subscribers are expected to increase to over 1 billion in 2026. (Digital TV Research)

- In 2023, US audiences streamed over 20 million years’ worth of video. That’s a 21% increase from 2022. (Nielsen)

- By 2025, British consumers are forecast to spend £4.2bn on SVOD services, that’s higher than the £4.1bn set to be spent on TV subscriptions. (Guardian)

- Most Connected TV viewers in the US are between 18 and 34 years old. That’s compared to 27% of those aged over 55 who watch videos through CTV each day. (Statista)

- 40% of US respondents have a cable television subscription, a decline of 7% since 2019. (Statista)

- When creators launch an OTT TV app, their earnings increase on average by 30%. (Uscreen)

- On-demand video streaming services now strive for the dollars and loyalty of existing streaming customers. Asked what they prioritize when choosing television providers, respondents emphasized costs, content, and convenience. (CordCutting)

Consumer behavior statistics

How your audience accesses your content is vital to developing your content production and, by extension, your business.

There are clear trends in the devices people use, how often they use them, and how devices, services, and platforms interact.

This is what we’ve found when it comes to how consumers behave watching OTT content.

- With 21 hours of content consumed per week, Americans spend the equivalent of a part time job streaming digital media in 2024. (Forbes)

- Around 245.3 million people (72.2% of the population) in the US will watch OTT video services at least once per month. That’s over 72% of the population. (Insider Intelligence)

- The global penetration rate in the ‘OTT Video’ segment of the media market is set to reach a new peak of 70.09%, by 2029. (Statista)

- According to Netflix, half of its subscribers access content on a mobile device each month. (Independent)

- UK households spent on average 17% longer viewing content on video streaming platforms than linear TV in H1 2023. (Samsung TV)

OTT device usage statistics

With so many devices available to audiences, it’s clear there are some complex patterns with how they are used. But where has the uplift been the strongest?

- Smart TVs’ highest penetration in the UK is among respondents aged 45-54 years old. (Statista)

- 98% of people aged 16-24 in the UK own a smartphone, compared to 86% of those aged 55-64. (Uswitch)

- There were 299.8 million smartphone units sold in Q3 2023. (Counterpoint)

- There was a 1% year-over-year decline in the global smartphone market distribution in Q3 2023. Shortage of components was identified as one of the main reasons for the deadline. (Counterpoint)

- The Middle East and Africa (MEA) exhibited the highest annual smartphone shipment growth in 2023 while North America experienced the highest decline. (Counterpoint)

Create your own OTT apps today

So there you have it, a comprehensive look at where the OTT industry is headed. We’ve seen growth across all fronts, and this is only the beginning.

If you’re an entrepreneur or marketer looking to get ahead of the curve, now is the time to start planning your entry into the world of OTT

Uscreen is one of the easiest ways to enter this fast-paced industry. We have OTT services for whatever your business needs. Create a website, host your videos, get paid, integrate all your favorite tools, and jump into the trends.

Get in touch to get a demo of everything we’ve got for you and get your business on the OTT train.

Build, launch and manage your membership, all in one place.

OTT statistics FAQ

The over-the-top video (OTT video) market reached over 120% penetration rate in the United Kingdom in 2023. Ranked second was Canada at over 117%, as per Statista.

The global OTT video market size is expected to top $429.40bn by 2029.

The United States has the largest market in OTT advertising with a volume of $84.61 billion in 2024. Compared to other countries, most OTT revenue will be generated in the United States, at approximately $132,900 million in 2024.

With OTT (Over-the-Top) services, you can watch films and TV on-demand on any device thanks to the internet. These platforms often offer cost-effective, personalized viewing experiences with vast content libraries and global accessibility. The OTT providers also have advanced analytics, multiple monetization models, and the goal of keeping content fresh.