There’s a ton of nuance that goes into deciding which payment model to adopt for your content business or app. But as far as money is concerned, we’ll sum it up for you.

- If you want instant cash flow and don’t mind month-to-month fluctuations, choose one-time payments.

- If you’re looking to build a massive revenue growth engine that compounds over time, recurring payments are what you need.

That said, you should look beyond your income needs too. Each of these payment models can potentially influence how customers experience your program, which has a big impact on your success in the long run.

How well your online content business grows depends on the model you choose!

One-Time Payment vs Recurring Payment

| One-time payment | Recurring payment | |

| Revenue | Lump sum upfront | Predictable stream over time |

| Customer Behavior/Loyalty | Unattached | Psychologically committed |

| Customer Acquisition | Higher customer acquisition costs | Lower customer acquisition costs |

| Customer Retention | Lower customer retention rates | Higher customer retention rates |

| Value Perception | High-value perception | Higher perceived value when paired with community |

What are recurring payments?

Recurring payments are fees that users pay on a set schedule to keep accessing your content, community, resource library, or other forms of your expertise.

Recurring payments can be subscriptions (payments that repeat at regular intervals, like monthly or annually), or payment plans (payment installments that expire after a set time.) These fees are automatic payments charged to customers’ credit cards (or debit cards.)

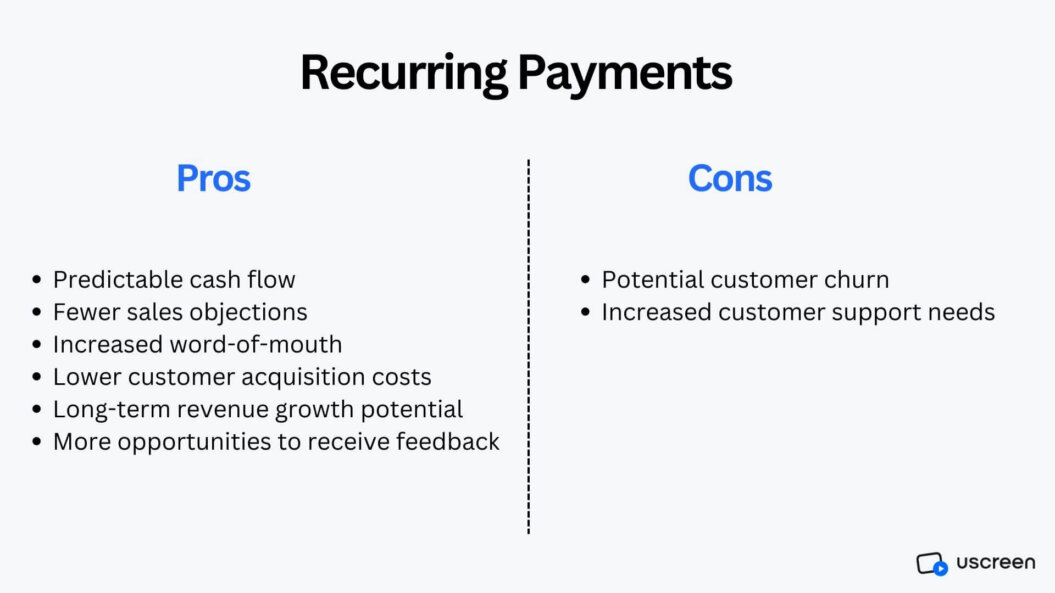

Recurring payments pros

- Fewer sales objections: If your one-time payment course sells for $250, you’d sell that same program for a monthly fee of around $25. That’s a smaller commitment for customers to make. Aside from the spread-out costs, a recurring payment program often has a bigger content library over time since you’ll keep adding videos to your subscription program. The lower price point and promise of more content encourage more people to, at least, try your program.

- Predictable cash flow: Let’s say you make $10,000 from recurring payments this month. If 90% of your subscribers renew their subscriptions each month, you know that even without making any new sales next month you’ll make around $9,000 (90% of this month’s revenue). This is one of the biggest benefits of recurring payments.

- Increased word-of-mouth: There’s at least one one-time payment course that you bought and never went through. But if you had to pay a recurring fee for that program, you’d be far more likely to use it on a regular basis. When subscribers pay recurring fees over time, they get a chance to experience all the benefits your program offers and become loyal advocates of it. You’ll get shoutouts on social media and more word-of-mouth referrals.

- Lower customer acquisition costs: If your subscribers send you customers through their advocacy, you’re spending less out of pocket to acquire new users.

- Long-term revenue growth potential: With the recurring revenue model, growth compounds. You don’t have to build your income from scratch every month and over time, that adds up.

- More opportunities to receive feedback: When people become regular paying customers, they’re invested in your program. This means they’ll want to help you find ways to improve it for them.

Recurring payments cons

- Increased customer support: Constant access to your program means that subscribers will run into issues that require support more often. While this isn’t an issue for memberships (because people will able to ask questions and get answers from members of the community), simple subscription business models will need to allocate more resources for support.

- Potential customer churn: There is a risk that subscribers will cancel if they’re not receiving enough value or benefits to justify the ongoing subscription cost. One important note: the typical churn rate for subscription services that include memberships is less than 10%, because an active community provides tons of value for people

What are one-time payments?

One-time payments are bulk fees that users pay once so they can access your content or program without restriction forever. Unlike recurring payments where people subscribe to an experience, one-time payments are final transactions.

For smooth transaction handling, you can also consider using an invoice template. It will ensure accuracy and reduce admin work.

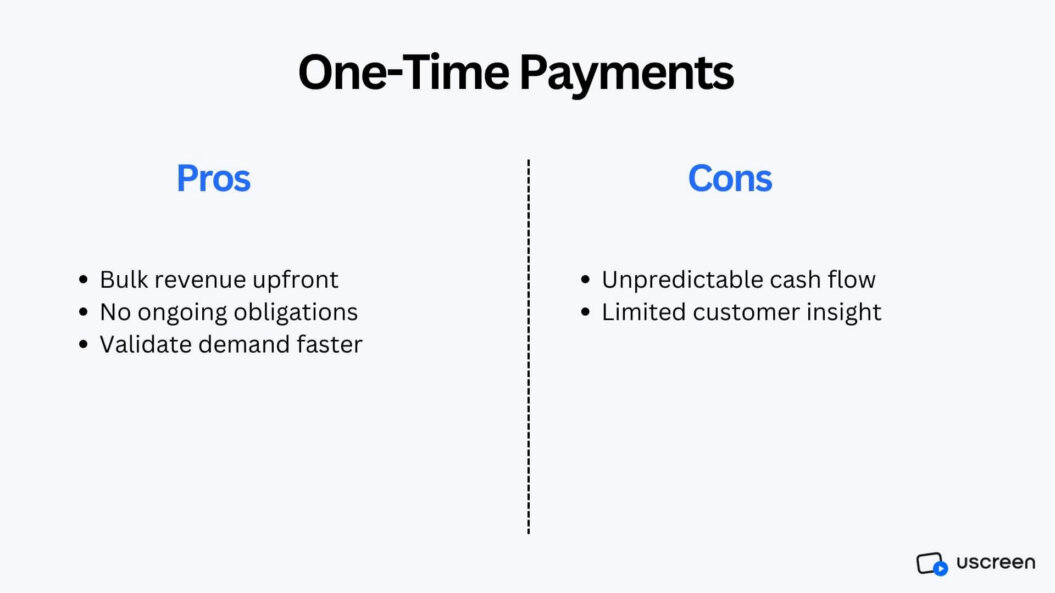

One-time payment pros

- Bulk revenue upfront: The point where a one-time payment course will make the most sense will always be at launch. If you promote your launch well, you’ll receive a bulk payment that you can use to fulfill any financial needs.

- No ongoing obligations: You don’t need to update your course information, or add new videos to keep students who already bought your course happy.

- Validate demand faster: It can take weeks to create enough content to keep users on a recurring billing cycle. But if people have been telling you to create a course, you can create a mini-course and launch it within 2 weeks to gauge the response from potential customers.

One-time payments cons

- Unpredictable cash flow: You’ll miss out on the recurring revenue that comes with subscription-based models. This unpredictability can lead to anxiety and stalled growth.

- Limited customer insight: Without the commitment to fixed recurring payments, fewer users will communicate their preferences to help you improve your program.

Which Model is Right for Your Business?

It’s easy to think, ‘I need money upfront’ and choose one-time payments, or decide to go with recurring payments because you’re prioritizing impact over money. But if you want to choose the right model for your goals, it’s best to consider the following factors:

- Your program topic/nature

- Your revenue expectations

- Your revenue growth timeline expectations

- The spending habits of your target audience

- Your competitor’s payment models

- How much time you want to commit

- How important making an impact is for you

- The size of your following

Use our quiz to decide which payment model to adopt based on your unique priorities:

Let’s walk through all those elements:

How specific or broad is your topic

Recurring billing businesses thrive on content so if your topic is very specific, you should use one-off payments only.

The decision between one-time and recurring payments often hinges on the nature of your content and audience. Alongside this, having access to reliable tools like an invoice generator can make the financial aspect of content creation much more manageable, regardless of your chosen payment model.

If you’re selling a program that teaches people how to polish horseshoes, for example, you’ll probably only make 20 videos from that. Even if people only watched 4 videos per month, they’d exhaust all of your content in month 5.

The only exception would be if your program included perks like a community, certification, or other add-ons that make sense for people to keep renewing their subscriptions.

Keep in mind that this doesn’t apply to niche industries. Specific topics teach a single skill, and niche industries service a specific audience. You can use recurring payments for a program that teaches people to raise Arabian horses as there’s a lot to cover.

For example, Matt of Adjuster TV uses recurring payments for his program that teaches people how to become claims adjusters. And he makes 5-figures a month doing so.

Your revenue expectations

Do you want to build a million-dollar business, or are you happy to get enough cash to cover the mortgage and utility bills?

It’s easier to generate $2,500 monthly with one-time payments than it is to earn $50,000 monthly. If you sell your course at a $250 one-time payment, you only need 10 sales per month to reach your goal.

For a $50,000 month, you’ll need to make 200 sales. But if you use recurring payments, you can slowly grow your subscriber base to 2,000 people paying $25 per month.

If you have bigger financial expectations, use recurring payments.

Your revenue growth timeline expectations

One-time payments start off strong and may be irregular, but you still get that upfront bulk payment.

Say you’re trying to raise $10,000 to complete a big financial goal and don’t mind constantly marketing and finding new customers, a one-time payment program could help you reach your goal at launch.

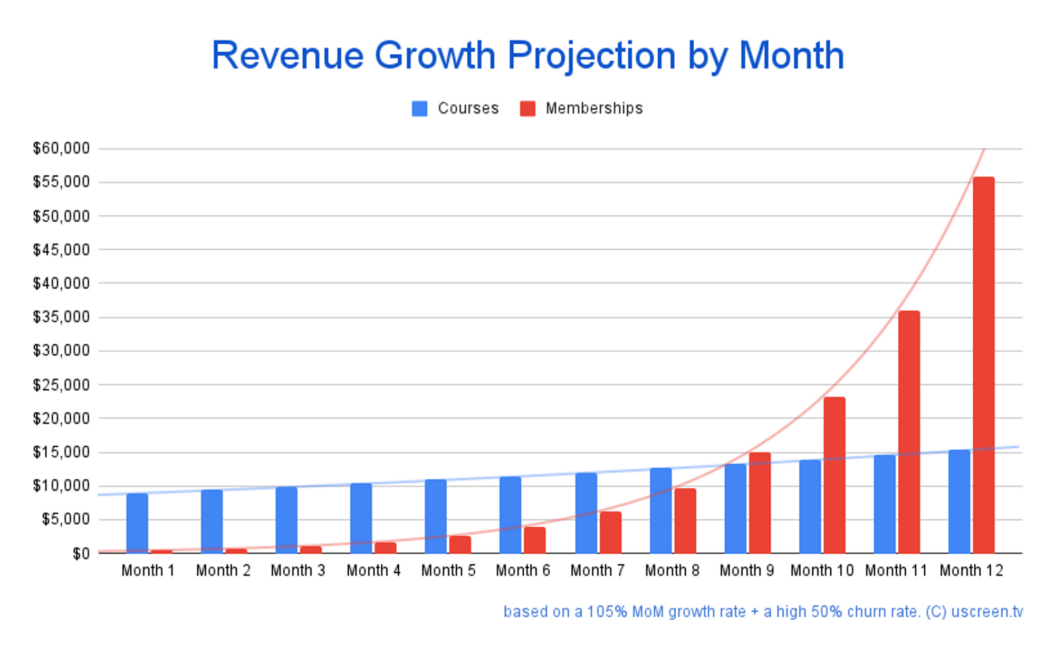

Recurring payments can start out slow but eventually catch up to (and overtake) the revenue made from one-time payments. Here’s a projection we recently made for our post on scaling your online course business.

The spending habits of your target audience

Recent studies show that Gen Z and millennials prefer subscribing to things rather than owning them. If you’re selling to a younger audience who have gotten used to subscription streaming services (like Netflix for example,) it makes sense to use recurring payments.

If your audience is made up of older people who may prefer to buy rather than rent things, it makes sense to consider one-time payments.

You can find your audience demographics in the audience analytics section of your social media profiles.

Your competitor’s payment models

If all the top competitors in your space use one-time payments then it makes sense to at least consider it.

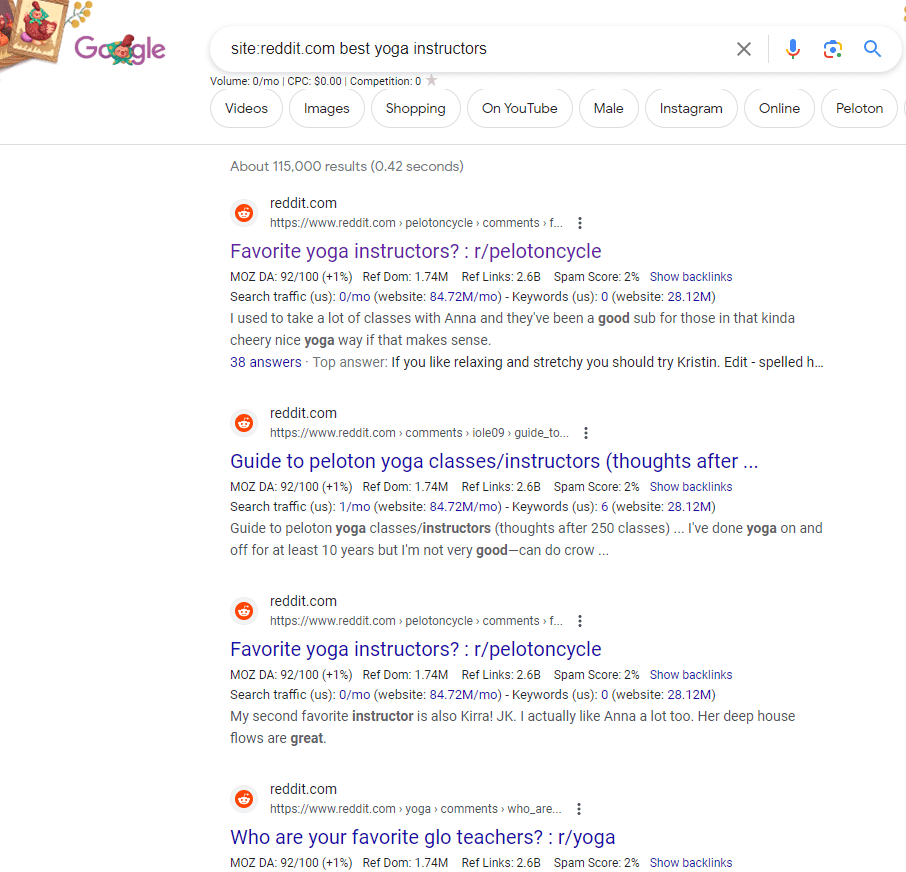

Search forums like Reddit to find competitor names that come up the most when people ask for recommendations. I like to use a Google site search for this: “site:reddit.com best [topic] instructor”

You could also ask your own audience and see who they mention.

Check out the pricing pages of your competitors to see what you learn.

How much time you want to commit

Big one-time payment courses require a huge time commitment upfront. You need to create enough videos for the bulk amount people pay to be worth it.

With recurring payments, you can start with a small selection of content instead and grow your library over time.

Also consider how much time you can commit to customer support and management, especially in the long run.

One-time payments require less support because it’s a more independent learning experience.

Recurring payments may require more active support, but you can also hire a customer support person. And if you add a community to your program, members will typically support each other.

How important making an impact is for you

It’s easy to add a community to a recurring payment course platform, and the community helps drive impact.

Your students will have people to celebrate, encourage, and help them. Your program begins to feel like family, or an experience — rather than a transaction — and so they’re more likely to see results from joining your program.

With one-time payments, most people buy and shelve for ‘later’.

The size of your following

If you have a small following (less than 1,000), and need to prioritize income from the start, it makes sense to launch one-time payment classes first.

10 people signed up to a $15 monthly subscription comes out to only $150, and that can be discouraging.

If money is not urgent, or you can wait to grow your following before you launch, then you can still consider recurring payments.

Wrapping up

The payment model you choose will depend on your unique needs.

But whichever payment model you choose, remember that your priorities and situation will change from time to time. It’s OK to reevaluate your stance when things change.

We’ve seen creators start out with one-time payments, for example, then switch to recurring payments after they’ve validated demand. We’ve even seen creators adopt both payment methods at once!

FAQs about one-time vs recurring payments

The main difference between one-time and recurring payments is that one-time payments are single and final while recurring payments happen more than once on a set schedule.

If you’re looking to generate bulk income upfront, then yes a one-time payment will serve you better than monthly. But if you’re looking to grow your business, monthly recurring payments are a better bet.

A one-time payment is a single and final payment made in exchange for permanent access to a course or program.

The two biggest disadvantages of one-time payments are the single payments which mean you have to constantly hunt for new customers, and the limitations around collecting customer feedback.